July 10, 2025

M&A Underwriting vs. M&A Brokerage

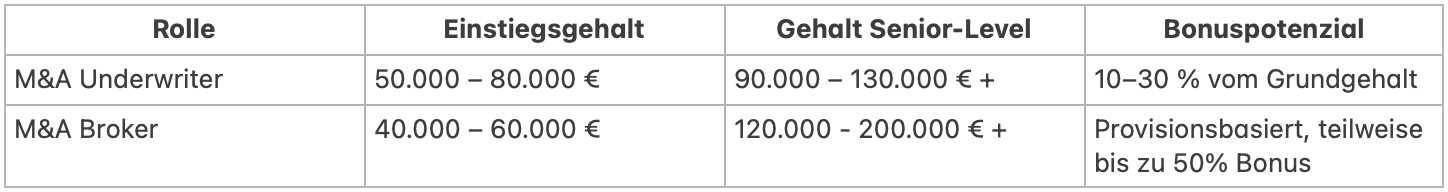

Wenn du eine Karriere im Bereich Mergers & Acquisitions (M&A) Legal in Deutschland anstrebst, stechen zwei Berufsfelder besonders hervor: M&A Underwriter und M&A Broker. Beide sind essenziell im Deal-Lifecycle, unterscheiden sich jedoch deutlich in ihren Aufgaben, Vergütungsmodellen und langfristigen Karriereaussichten. Hier ein Überblick, der dir hilft, die Unterschiede und Chancen der beiden Rollen besser zu verstehen.

Was macht ein M&A Underwriter?

M&A Underwriter konzentrieren sich auf die Bewertung und das Management des finanziellen Risikos von M&A-Transaktionen. Sie arbeiten meist bei sogenannten MGAs (Managing General Agencies) und zu ihren Aufgaben gehören:

Underwriter sind analytisch, detailorientiert und spielen eine entscheidende Rolle beim Schutz des Kapitals und bei nachhaltigenTransaktionen.

Was macht ein M&A Broker?

M&A Broker agieren als Vermittler zwischen Käufern und Verkäufern und fokussieren sich auf:

Broker sind kundenorientierte Profis mit starkemFokus auf Deal-Generierung und -Abwicklung.

Karriereperspektiven

Unterwriting:

Unterwriting-Positionen bieten klare Aufstiegsmöglichkeiten. Vom Junior oder Assistant Underwriter kannst du dich zu Senior-Rollen und später in Führungspositionen im Kreditrisiko, Portfoliomanagement oder sogar auf C-Level hocharbeiten. Viele wechseln auch in Private Equity, zu Kanzleien, Beratungen oder Corporate Development.

Brokerage:

Broker bauen ihre Reputation durch erfolgreiche Transaktionen und ein starkes Netzwerk auf. Mit der Zeit kannst du Teamleitungen übernehmen, Partner in Beratungsfirmen werden oder eine eigene M&A-Beratung gründen.

Unternehmerisches Wachstum: Broker mit starkem Track Record werden oft zu vertrauenswürdigen Beratern von Investoren oder Familienunternehmen. Spezialisierung auf bestimmte Branchen (z. B.Industrie, Konsumgüter, SaaS) führt zu Nischenexpertise und höheren Honoraren.

Willst du offene Positionen entdecken oderpersönliche Beratung?

Kontaktiere unser Team – wir unterstützen dich gern bei deinem nächsten Karriereschritt im M&A-Bereich!